How Finance Leaders Steer Growth-Focused Businesses

In today’s dynamic business landscape, finance leaders play a pivotal role in steering growth-focused businesses towards success.

They are not merely number-crunchers but strategic partners who use financial insights to make informed decisions, optimize resources, and drive sustainable growth.

In this article, we will delve into the multifaceted responsibilities of finance leaders and explore how their expertise shapes the future of thriving enterprises.

In an era of rapid technological advancements and market disruptions, businesses must navigate a complex landscape to achieve sustainable growth. Finance leaders, often referred to as CFOs (Chief Financial Officers) or finance directors, are at the forefront of this journey.

They are responsible for much more than just balancing the books; they are strategic partners who provide valuable insights to steer their organizations towards growth and profitability.

The Evolving Role of Finance Leaders

Adapting to Change

Finance leaders are no longer limited to traditional financial tasks. They must adapt to a constantly changing business environment, staying ahead of economic shifts, industry trends, and regulatory updates.

Strategic Decision-Making

One of their primary roles is to participate in strategic decision-making. They collaborate with other executives to align financial goals with the overall business strategy. This involves assessing the financial viability of various initiatives and ensuring that investments drive growth.

Financial Planning and Analysis (FP&A)

Budgeting for Growth

Finance leaders play a crucial role in budgeting for growth. They develop financial plans that allocate resources efficiently, ensuring that investments are aligned with the company’s growth objectives.

Risk Assessment

Additionally, finance leaders are responsible for risk assessment. They identify potential financial risks and develop strategies to mitigate them, ensuring the company’s stability in uncertain times.

Capital Allocation

Investment Prioritization

Finance leaders determine where the company should invest its capital. This involves prioritizing projects and initiatives that are most likely to generate returns and foster growth.

Resource Optimization

They also focus on resource optimization, making sure that every dollar is spent wisely. This efficiency in resource allocation is vital for sustained growth.

Data-Driven Insights

Harnessing Big Data

In the digital age, data is a valuable asset. Finance leaders leverage big data analytics to gain insights into consumer behavior, market trends, and financial performance.

Predictive Analytics

They use predictive analytics to forecast future financial scenarios, allowing the organization to proactively adapt to changing market conditions.

Compliance and Governance

Navigating Regulations

Finance leaders must navigate a complex web of regulations and compliance requirements. Ensuring that the company adheres to these regulations is crucial for avoiding legal and financial setbacks.

Ethical Financial Practices

Ethical financial practices are also paramount. Finance leaders set the tone for the organization, ensuring that all financial decisions are made with integrity and transparency.

Communication and Collaboration

Cross-Functional Teams

Effective communication and collaboration are essential. Finance leaders work closely with cross-functional teams, translating financial insights into actionable strategies.

Stakeholder Engagement

They also engage with stakeholders, including shareholders, investors, and lenders, to build trust and secure support for growth initiatives.

Case Studies: Finance Leaders in Action

To illustrate the impact of finance leaders, let’s explore a few real-world case studies where their strategic guidance has driven growth in various industries.

Challenges and Solutions

Adapting to Market Volatility

Finance leaders face the challenge of navigating market volatility. They must develop strategies to mitigate financial risks in uncertain economic conditions.

Talent Acquisition and Retention

Another challenge is attracting and retaining top financial talent. Finance leaders play a key role in talent development and succession planning.

Future Trends in Financial Leadership

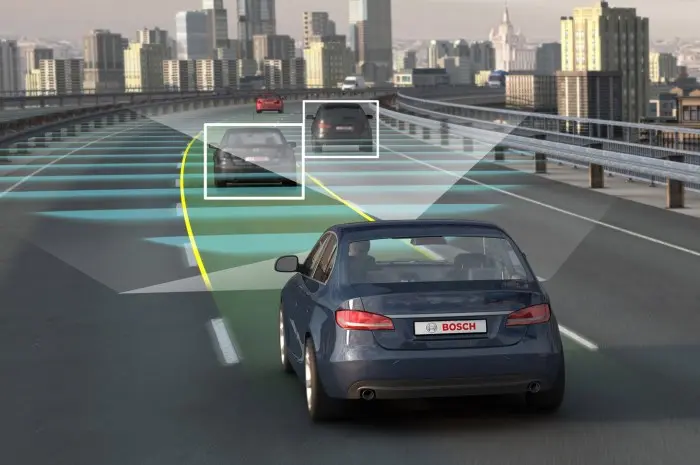

AI and Automation

The future of financial leadership is closely tied to artificial intelligence and automation. These technologies will streamline financial processes and provide even more data-driven insights.

Sustainability Integration

Sustainability is becoming increasingly important. Finance leaders will be tasked with integrating sustainability goals into financial strategies, aligning with societal and environmental concerns.

Conclusion

In the ever-changing business landscape, finance leaders are the architects of growth-focused businesses. They navigate complexity, provide strategic direction, and ensure financial integrity. Their role will continue to evolve, shaping the future of successful enterprises.